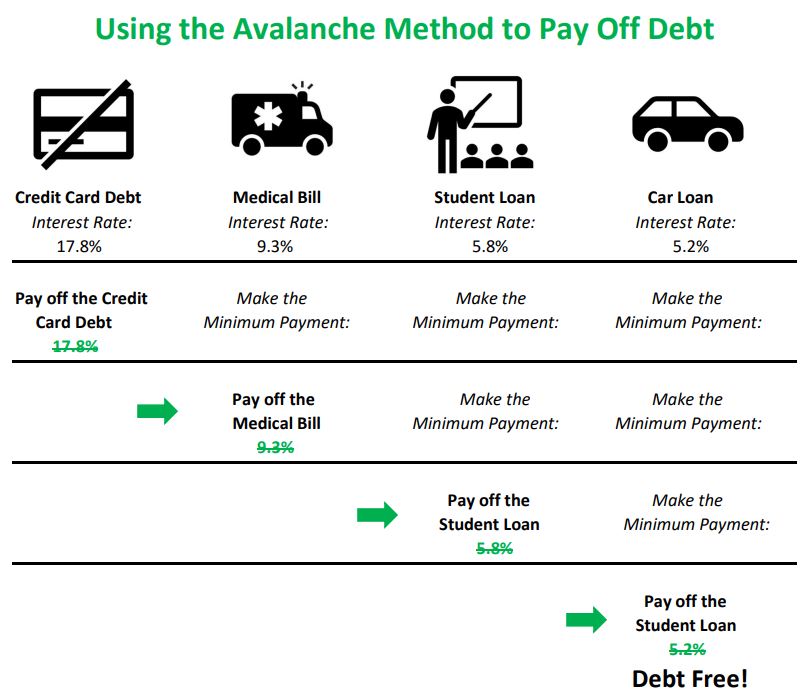

When it comes to paying off debt there are two notable methods, the avalanche method and the snowball method. The avalanche method focuses on paying off the loan with the highest interest rate first before moving on to the next highest interest rate.

Step 1: Make sure your budget is up to date. If you don’t have one, now would be a great time to create your monthly budget!

Step 2: List all your outstanding debts, loans, and bills with payment plans. (This would not include your Mortgage) You need to be honest about your debt and your situation, don’t hide any debts under the table.

Step 3: Sort those debts by the highest interest rate to the lowest interest rate, regardless of total amount still owed or the monthly payment.

Step 4: Continue to pay the minimum payments on all loans. Use extra money found in your budget and put it towards the 1st loan (highest interest) until that loan in completely paid off.

Step 5: While continuing to pay the minimum payments of the remaining loans, take the money you were putting towards the 1st loan and add that to the payment of the 2nd loan until that loan is also paid off.

Step 6: Repeat step 5 as many times as necessary until all outstanding debts are paid off!

It this example, you would put any extra money towards the credit card debt. Then the medical Bill. Then the student loan and finally, all you would have left is the car loan.

Think about trying to demolish a snowman. If you start at the top, you can take out the head in a hit or two, but you will have the stomach and the base of the snowman to take out still. If you start at the bottom and work your way up, you will loosen the snow at the top so when you demolish the bottom the top quickly tumbles.

No matter how you tackle your debt, you have to keep working towards it!

© EuduringFinances, 2021. All Rights Reserved.

Related Posts –

3 thoughts on “How the Avalanche Method Knocks Your Debt Out Fast!”

Comments are closed.