While I know we all want to be able to retire one day, that journey will be different for each of us. No one person will be at the same stage in their own process. Some might be focusing on paying off student loans while others could be focusing on saving for a down payment for a house or just trying to keep the lights on.

But no matter what, there are certain bases that everyone should cover on their journey.

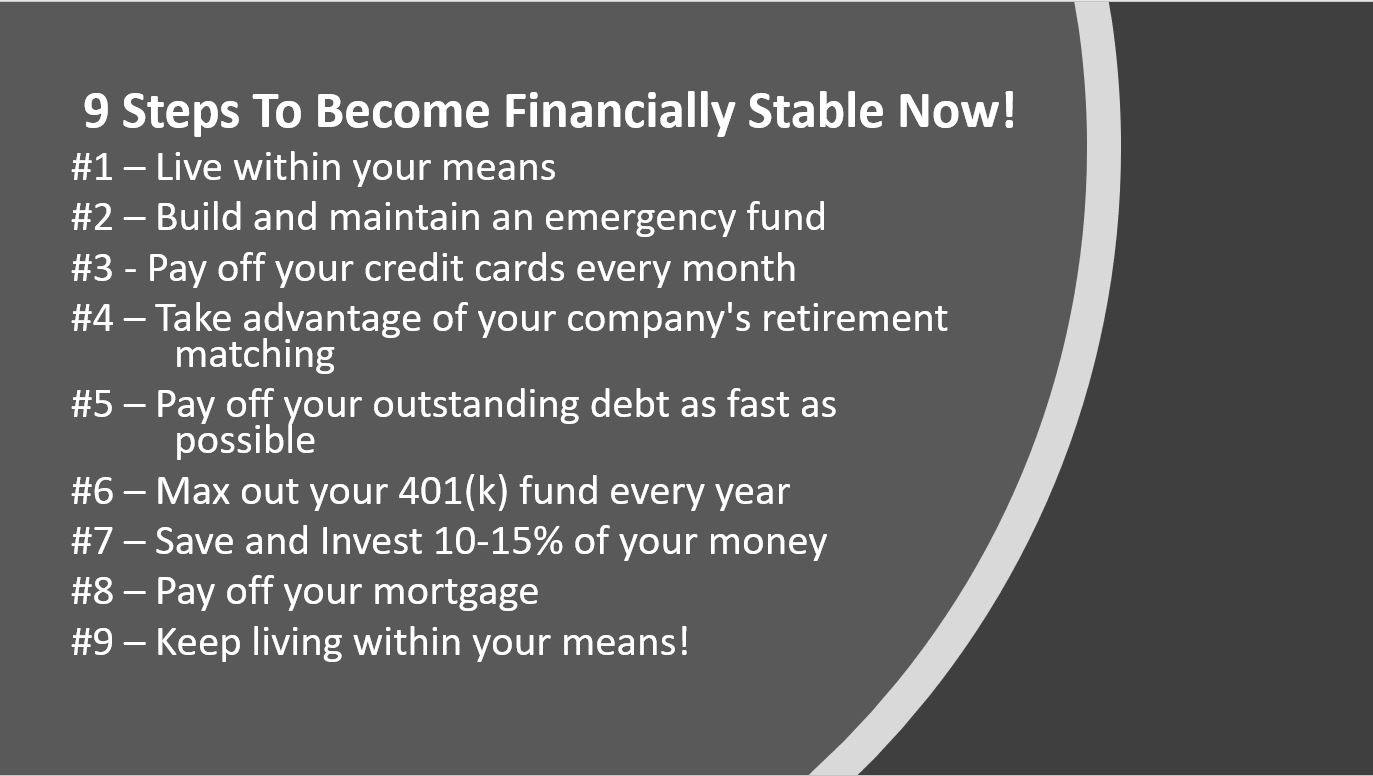

#1 Live within your means! In 2017, Career Builder conducted a study in the United States and found that 71% of all workers are living in debt. America is built on a consumer economy. You are encouraged to buy from ads on cartoons, to billboards, to magazines. Having more is the best way to go right!? I don’t think so. If you are struggling to put food on the table, you shouldn’t be buying a brand new car or video game. So have a budget and stick to it!

#2 Build and maintain an emergency fund. Your emergency fund should cover your expenses for at least 3 months, 6 months would be better! This is backup to use when things hit the fan. Like when your car breaks down or your apartment floods. It is your safety net that should always be tucked away so you don’t have to take out a last minute loan to get through.

#3 Pay off your credit cards every month. Make the minimum payment every month. While you might not be at a place to pay off extra, you don’t want to miss a payment. It is very easy to miss a payment, owe late fees, and then fall deeper into the debt trap month after month.

#4 Take advantage of your company’s retirement fund matching. Meaning your company offers to match a percentage of the money you put towards retirement. For example, if you put $50 of your own paycheck, your company add their own $50, making the totally $100. If you don’t, you are letting free money go… every month.

Those first four bases are the foundation that you need to develop and build off of moving forward. Once you have them in place, its time to move to the big leagues!

#5 Pay off your outstanding debt. It’s time to get rid of those liabilities! Even if that means just an extra $15 a month towards your student loans. Every bit counts! There are a few different approaches on getting out of debt; the snowball method, the avalanche method, and consolidating all of your debt. What ever approach you take, make sure it is the one that works best for you! I want you to be debt free! (This does not include your mortgage, that falls into more of an investment category rather than a true liability like credit card debt.)

#6 Max out your 401(k) Employee fund every year. This is the new “pension” plan created by Congress in 1986. The tax benefits you gain from these plans can’t be matched in your personal investing. You can save on taxes right now or you can save on taxes when you retire or, maybe a little of both! You can only contribute a limited amount of money each year so it’s important to use time to your full advantage.

#7 Save 10-15% of your money. Even better would be 20%. Ever heard the phrase don’t place all your eggs in one basket? This is where it becomes important! You want to have your fingers in a few different pies as the same time. Some people really focus on investing in Real Estate, others focus on Stocks, bonds, or mutual funds. You want to spread out the money you are saving in different avenues.

#8 Pay off your Mortgage. You want to own your own home outright! If the economy has another hard year or two, you want to know that you have a roof over your head no matter what. Most people have a 30-year mortgage so, we know that this is a long-term play. It could be in 10 years or maybe even 20 before you start but, this should be a goal for everyone buying their own home.

#9 Keep living within your means and saving for the future. This is the most important step of all! It should be part of your process for the rest of your life. No matter what promotion or new job you may get, you need to keep focused on not spending more than you make. Career Builder’s study also found that 59% of people who make more than $100,000 a year are still living in debt. Just because you get a raise does not mean your expenses need to increase as well. Life is hard, money is hard. That doesn’t mean you shouldn’t live a little but, don’t buy a $30,000 car just because you got a 5% raise. You just have to do the best that you can and keep focused on your end goal.

Resources –

Career Builder, Press Release 8/24/2017. Living Paycheck to Paycheck is a Way of Life for Majority of U.S. Workers, According to New CareerBuilder Survey

Vanguard. “How America Saves 2019: The Retirement Savings Behavior of 5 Million Participants.”

© EuduringFinances, 2021. All Rights Reserved.

Related Posts –