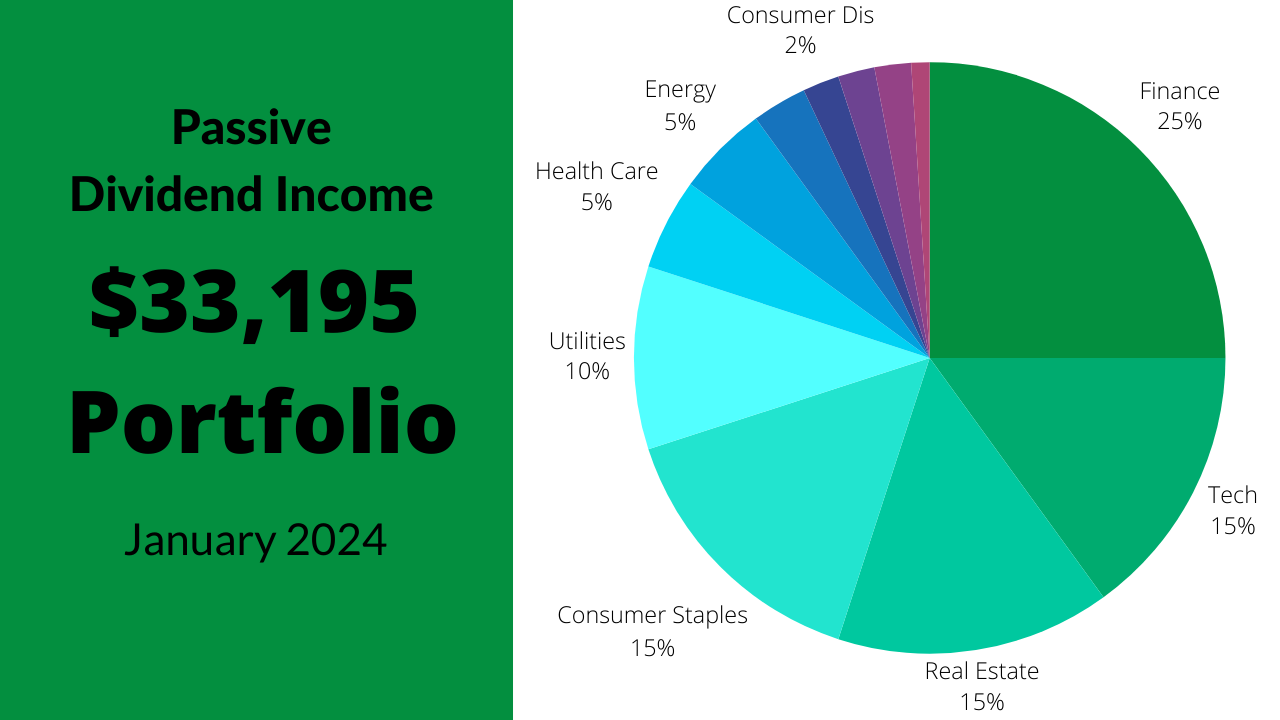

I have a self-directed brokerage account with Ally. My overall goal is for the portfolio to function as a long-term dividend growth account that generates around $2,000 per month in dividends. My diversification strategy is broken-down by these different sectors and areas –

Portfolio Overview –

We closed out the month of January with the portfolio being valued at $33,195. The overall value increased by a whopping 0.32%…

All in all, I earned 22 different dividends so, lets take a look at what they were!

| Stock Symbol | Dividend Amount | – | Stock Symbol | Dividend Amount |

|---|---|---|---|---|

| BNS | $3.25 | – | MRK | $1.54 |

| COST | $45.00 | – | NLY | $20.80 |

| CSCO | $0.39 | – | NYMT | $20.00 |

| DIN | $1.02 | O | $1.80 | |

| EFC | $4.95 | – | PM | $9.10 |

| EMN | $0.81 | – | PPL | $2.40 |

| GSK | $1.75 | – | QSR | $0.93 |

| JPM | $7.35 | – | RITM | $11.50 |

| LTC | $1.90 | – | STAG | $0.49 |

| MDLZ | $1.54 | – | TD | $1.94 |

| MDT | $2.07 | – | USB | $7.84 |

In total, I took home $148.63 in dividends this month!

Rebalancing My Portfolio –

I purchased 7 new shares of stock this month lets take a look at what they are!

| Sector | Ticker Symbol | Purchase Price | Number of Shares |

|---|---|---|---|

| Real Estate | NLY | $19.47 | 1 |

| Telecomm | SIRI | $5.17 | 4 |

| Real Estate | O | $58.63 | 1 |

| Real Estate | RITM | $10.60 | 1 |

To wrap up, here’s my favorite statistics of the progress I am making towards reaching my long-term goals!

| Divided Yield | 3.84% |

| Dividend Avg Per Year | $1,270.96 |

| Dividend Avg Per Month | $105.92 |

| Dividend Avg Per Week | $24.44 |

| Dividend Avg Per Day | $3.48 |

| Dividend Avg Per Hour | $0.145 |

| Dividend Avg Per Minute | $0.002 |

| Dividend Avg Per Hour 40hr Week | $0.611 |

© EuduringFinances, 2024. All Rights Reserved.

Related Posts –