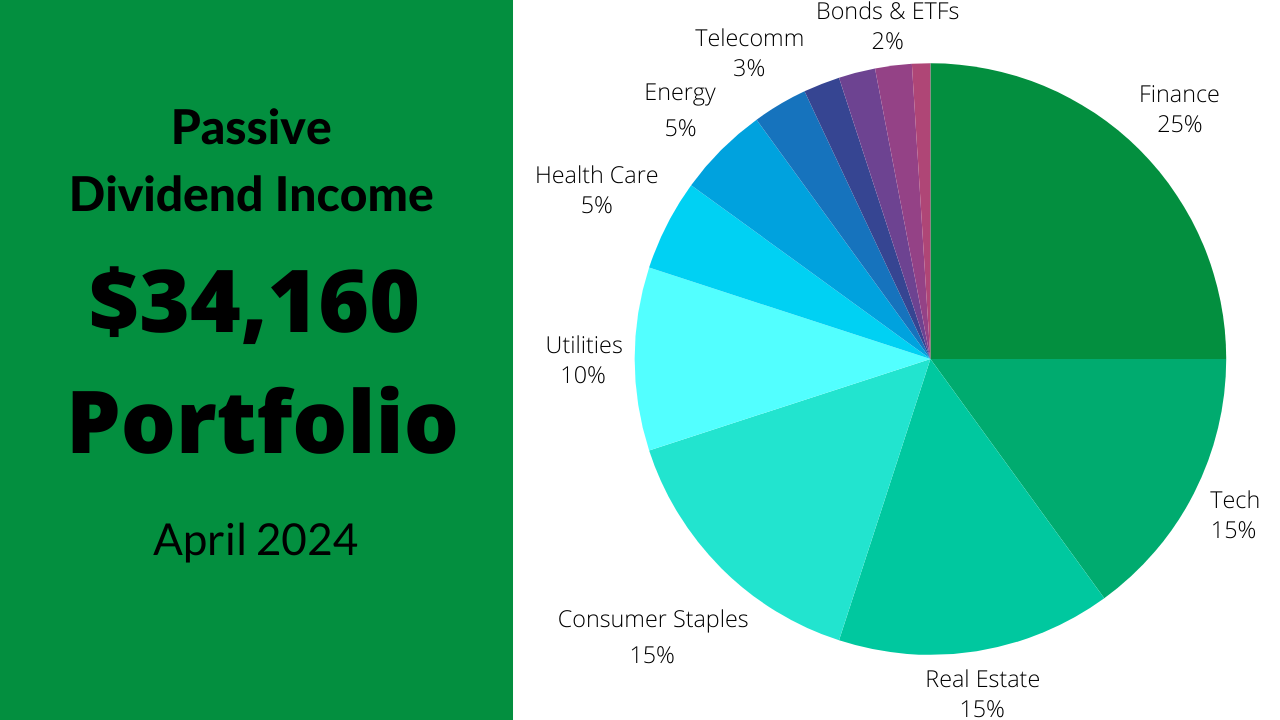

I have a self-directed brokerage account with Ally. My overall goal is for the portfolio to function as a long-term dividend growth account that generates around $2,000 per month in dividends. My diversification strategy is broken-down by these different sectors and areas –

Portfolio Overview –

We closed out the month of April with the portfolio being valued at $34,160! The overall value decreased by -1.95% or a loss of $675.17…

All in all, I earned 29 different dividends so, lets take a look at what they were!

| Stock Symbol | Dividend Amount | – | Stock Symbol | Dividend Amount |

|---|---|---|---|---|

| AVGO | $10.50 | – | MDLZ | $1.70 |

| BAC | $7.44 | – | MDT | $2.07 |

| BNDX | $0.27 | – | MRK | $1.54 |

| BNS | $3.29 | – | NLY | $21.45 |

| CSCO | $0.40 | – | NYMT | $20.00 |

| DIN | $1.02 | – | O | $2.57 |

| EFC | $7.15 | – | PM | $9.10 |

| EMN | $0.81 | – | PPL | $3.86 |

| GSK | $1.99 | – | QSR | $0.10 |

| JPM | $8.05 | – | RITM | $11.75 |

| KHC | $3.20 | – | STAG | $0.49 |

| KO | $7.28 | – | TD | $1.89 |

| LTC | $1.90 | – | TRV | $2.00 |

| LTC | $1.90 | – | USB | $7.84 |

In total, I took home $144.71 in dividends this month!

Rebalancing My Portfolio –

I sold 50 shares of my NYMT stock and purchased 18 new shares of stock this month lets take a look at what they are!

| Sector | Ticker Symbol | Purchase Price | Number of Shares |

|---|---|---|---|

| Real Estate | NYMT | -$7.29 | -50 |

| Real Estate | CCI | $96.99 | 1 |

| Real Estate | NLY | $18.49 | 5 |

| Real Estate | O | $52.19 | 1 |

| Real Estate | RITM | $10.72 | 7 |

| Real Estate | STAG | $37.30 | 7 |

To wrap up, here’s my favorite statistics of the progress I am making towards reaching my long-term goals!

| Divided Yield | 3.70% |

| Dividend Avg Per Year | $1,261.28 |

| Dividend Avg Per Month | $105.11 |

| Dividend Avg Per Week | $24.29 |

| Dividend Avg Per Day | $3.46 |

| Dividend Avg Per Hour | $0.144 |

| Dividend Avg Per Minute | $0.002 |

| Dividend Avg Per Hour 40hr Week | $0.606 |

© EuduringFinances, 2024. All Rights Reserved.

Related –