A dividend is a portion of a company’s earnings paid out to its investors which are people who own shares, or a portion of the company’s stock. Think of the company as a building made out of bricks. When you invest in the company, you are essentially buying a brick in their wall. It could a new brick with a company that is just starting out as an IPO or maybe the company is doing really well, and your neighbor is ready to buy a different brick and is looking to sell theirs.

As long as you hold on to the brick, the company is going to say “Hey, thanks for believing in us! Here’s a little bit of money to show how much your support means to us!” Then they take a small portion of their earnings and give it back to you as a dividend.

Now, not all companies are built the same. Some might pay out higher dividends than others and some don’t pay any dividends at all. It doesn’t mean the company is a bad investment choice just because it doesn’t pay out a dividend, it’s just not in their business plan.

How often is a dividend paid out?

Most of the time, a dividend is paid out every single quarter or 4 times a year. Some companies choose to pay out monthly, twice a year, or maybe just once a year. The amount paid out and the frequency of payments is determined by each company and its own board of directors.

How are dividends paid out?

A dividend is usually paid in cash or in the form of additional shares of the company’s stock. You won’t get a check sent to your house but, the money will be deposited directly into your brokerage account. Then, you can then either reinvest the money into more stocks or you can withdraw the money and use it to pay your bills or cover your next vacation.

Do you have to hold a stock for a certain period of time to receive a dividend?

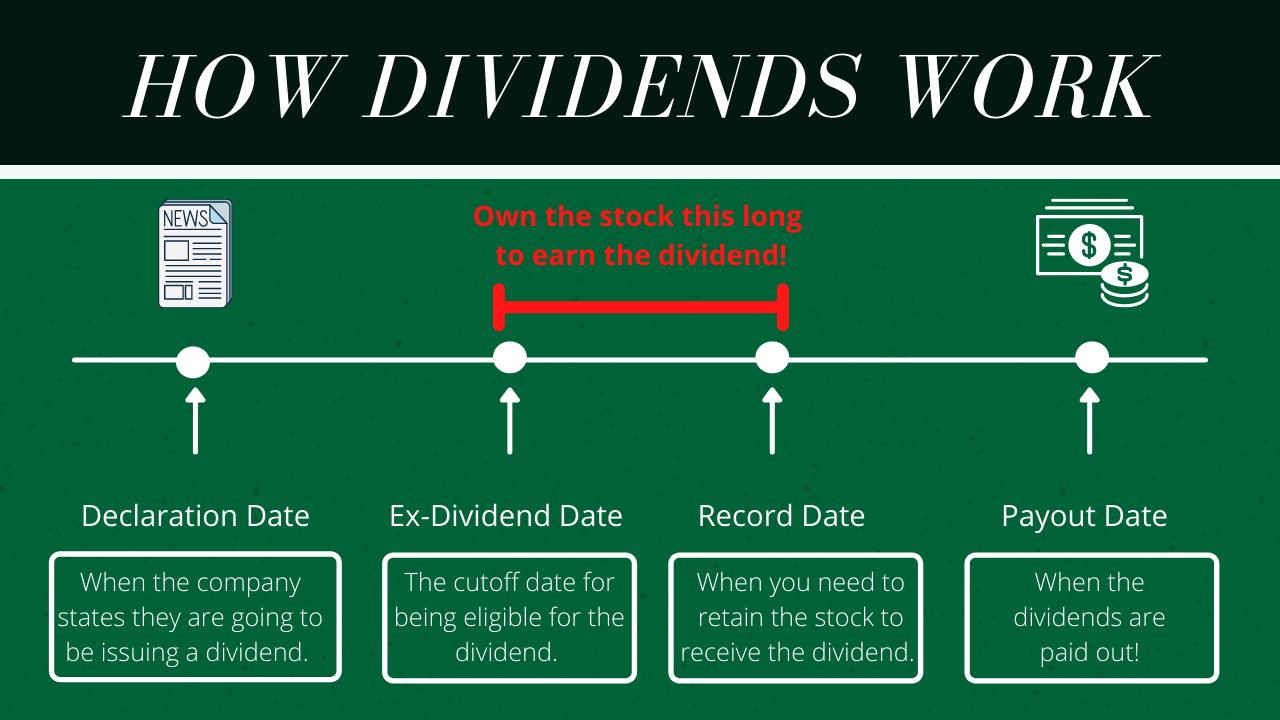

Kind of! There are a few key days that you need to watch out for!

- The Declaration Date which is when the stock company (owners of the brick) state they are going to be issuing a dividend. (Typically, the stock price will rise by the amount of the dividend being issued on this date.)

- The Ex-Dividend Date is the cutoff date for being eligible for the declared dividend. You need to own the stock (the brick) before the Ex-Dividend Date. If you buy the stock on or after the Ex-Dividend Date, those shares will not be eligible for a dividend payout this time around. (Typically, the stock price will drop by the amount of the dividend being issued on this date.)

- The Record Date is how long you at least need to retain the stock (the brick) to receive the dividend. Typically, it’s the next business day after the Ex-Dividend Date. If you sell a stock before the Record Date, you won’t be able to earn the dividend.

- The Payout Date is the best day in this group! It’s simply the date when the dividends are paid out!

It’s important to remember that you need to buy the stock (the brick) before the Ex-Dividend Date and hold on to it until after the Record date to earn the dividend!

What is the dividend yield?

The dividend yield is simply a way to calculate your return on investing in the stock. Its like looking at interest rates for a car loan except you are the one receiving the payments! You divide the annual dividend (your payout for owning the brick), by the price of the stock (aka the current cost to own a single brick).

Here are a couple of examples –

I like to look at the dividend yield (aka the amount I would get back for owning the brick) by comparing what each stock, or brick, would earn if I invested $1,000.

- $1,000 in CINF = 8.62 shares or $21.72 a year

- $1,000 in GWRS = 60.13 shares or $17.74 a year

What happens when the stock price rises or falls? Does the dividend go away?

Sometimes… BlackRock Capital Investment Corporation (BKCC) has been reducing its dividends for the past 14 years. It dropped from $0.42 to only $0.10 a share. The company’s stock price has also steadily decreased from over $10.00 (at its high) to under $5.00 a share.

However, Global Water Resources, Inc. (GWRS) has been increasing its dividend by a fraction of a penny since 2016. The company’s stock price was around $8.00 a share for a couple of years, and it still was increasing the dividend even with the ups and downs of a being a new company in the stock market.

Slow and steady increases are a really good sign! Like Cincinnati Financial Corporation (CINF). They have been slowly increasing its dividend for the last 20 plus years. And the company’s stock price has also steadily risen from under $25.00 to over $115.00 a share.

Does the dividend payout increase overtime?

Yes! Most companies will increase the dividend amount every single year. You can look at the NASDAQ Dividend Calendar to see how a company’s dividends have behaved in the past.

Do you have to pay taxes on dividends? –

Yes, you do unfortunately. Any selling of stock and dividends earned, are taxable. But there is a plus side! Qualified Dividends are taxed at a much lower “long-term capital gains” tax rate, rather than the regular income tax rate. If you earn less than $40,500 and are single or less than $80,000 and are married, you won’t pay any taxes on those qualifying dividends! Woot, woot! Last year, 65% of my earned dividends were Qualified Dividends! If you have regular, Ordinary Dividends, they are taxed at your regular income tax rate, like your paychecks.

You should receive a 1099-DIV Form, from each company/stock that pays out at least $10.00 in dividends. Also, per IRS guidelines if you earn more than $1,500 in Ordinary Dividends, you are required to complete Form 1040.

Investing in dividends is a long-term strategy. You’re not going to make a ton of money in the next week or so… But, if you want passive income in the future, like 15-20 years from now, dividend investing is a smart way to go! If you want to learn more about it, check out my $30,000 dividend stock portfolio breakdown to see how you can earn over a $1,000 in dividends every year!

© EuduringFinances, 2021. All Rights Reserved.

Resources:

https://www.nasdaq.com/market-activity/dividends

https://www.irs.gov/taxtopics/tc404

https://www.irs.gov/taxtopics/tc409

https://www.irs.gov/instructions/i1040gi#en_US_2020_publink24811vd0e4966

https://www.irs.gov/newsroom/irs-provides-tax-inflation-adjustments-for-tax-year-2021

Related Posts –

2 thoughts on “What Is A Dividend? | Long-Term Growth Investing 101”

Comments are closed.