What Is Inflation? Inflation is the impact of rising prices paired with the buying power of money decreasing overtime. Meaning a dollar today is worth more than a dollar will be worth tomorrow. Let’s look at 50 years ago, in 1971, $15.22 had the same buying power as $100 did in January of 2021! A … Read More “Inflation And The Value Of Money Today Vs Tomorrow” »

Tag: Saving Money

A couple of months ago, I received a notice from my local water provider. The notice was identified as an “Important Responsibility Message” with a requested response in 30 days. Then a month or so ago, I received a second notice and then just recently a third notice came that pushed the same information. The … Read More “Do You Need Water Service Line Coverage?” »

Since the 1970’s, we’ve witnessed a change in how some companies manufacturing and inventory systems work. The Toyota Productions System led the charge by transitioning from a Just-In-Case inventory system to a Just-In-Time one. But what does that really mean? Just-In-Case (JIC) means enough products, parts, and inventory will be available if the supply chain … Read More “Food Storage And Its Importance With Supply Chain Shortages” »

We’ve been reading about it in the news for months, people are quitting their jobs by the thousands. In August, more than 4.5 million people quit their jobs in the United States. Then you factor in the other 11.5 million people who quit earlier this year and the numbers are staggering. Anthony Klotz phrased it … Read More “The Great Resignation – Should You Quit Your Job?” »

October is always a good month! With Halloween and fall colors turning all the trees into a wonderful art piece its hard to compete with! What I worked on this month – October was a big month of planning and preparing. I finished my last day with my employer on the 29th and out my … Read More “Personal Update #9 – October 2021 | Working For Myself As An Entrepreneur” »

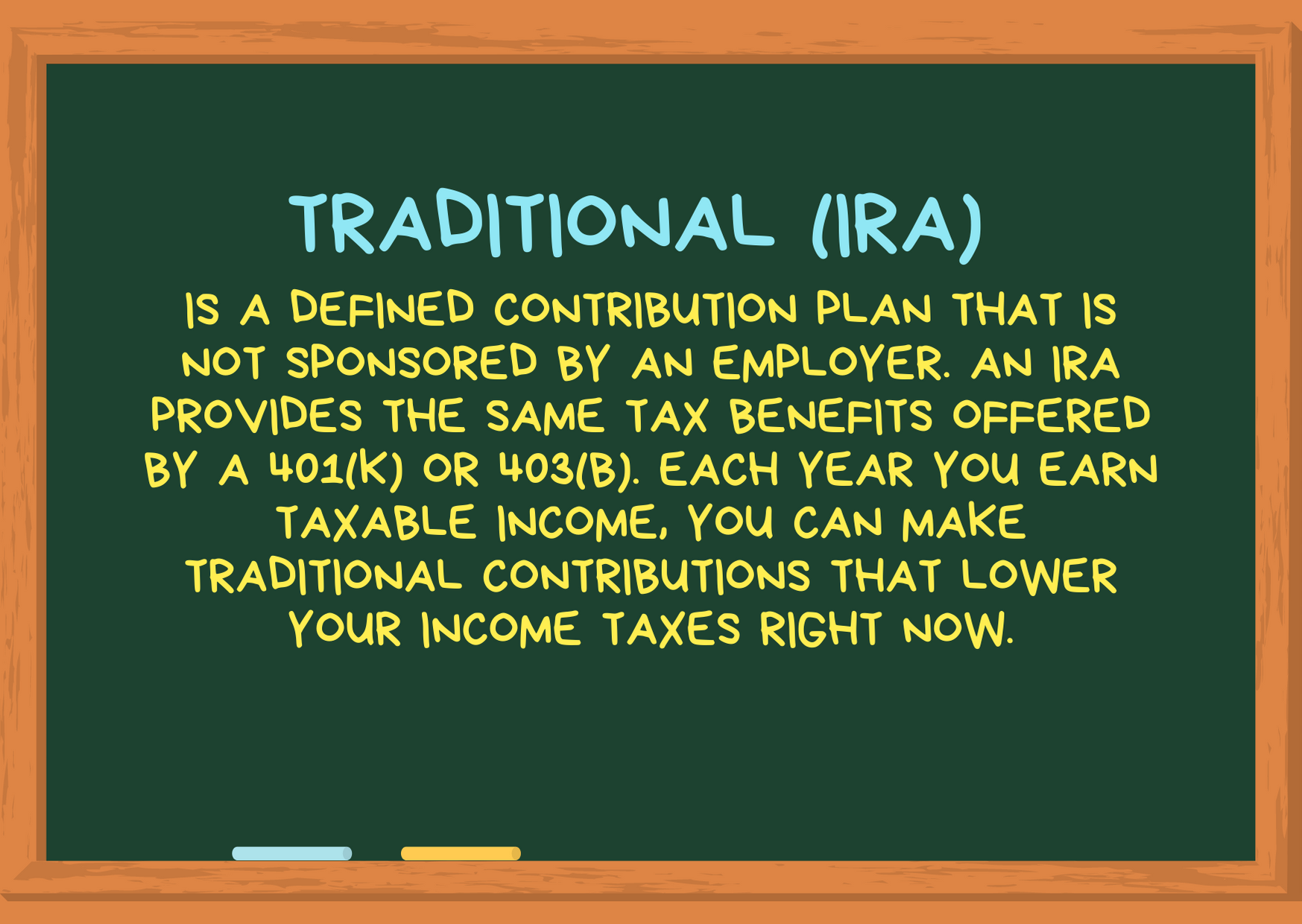

An IRA is a tax advantaged retirement account that is not sponsored by an employer. Meaning, you can still receive similar tax benefits as a 401(k) even if your employer does not offer a retirement plan. Even if you participate in a retirement plan sponsored by your employer, you can still contribute to an IRA … Read More “What Exactly Is An Individual Retirement Account?” »

Disclaimer Notice: “Neither enduringfinances.com nor any of its partners or representatives is in any way affiliated with the United States Government, The Federal Retirement Thrift Investment Board or the Thrift Savings Plan, and that the service being offered is not sanctioned by the United States Government, the Federal Retirement Thrift Investment Board or the Thrift … Read More “What Is A Thrift Savings Plan (TSP)?” »

Looking down the road, planning for retirement is a major stressor for just about everyone. How much money will I need to retire? Will Social Security Benefits still be around? Will I have enough money to retire for good? How long will my retirement last? When it comes to saving for retirement and your golden … Read More “Understanding Retirement Accounts: Which One Is Best For You?” »

Here are 7 ways to put your stimulus check to good use! Pay Any Late Bills Stock up on Food Storage Put it towards your Emergency Fund Max out your 2020 or 2021 IRA Pay on High Interest Debt/Loans Invest it for the long haul Donate it to a charity or someone/place in need. So, … Read More “What Should You Do With Your Stimulus Check?” »

The rule of 72 is a simple way to figure out how long it will take an amount of money to double. All you need to do is divide 72 by the annual interest rate. This will give you a relatively close estimate to the number of years before your money is doubled. [72 … Read More “What is the Rule of 72 and How Does it Work?” »