Howdy folks! November has been a really good month for me and my business ideas! I cranked out a lot of work that had piled up and really hit a groove with workflow and all that good stuff! What I worked on this month – The Great Resignation – Should You Quit Your Job? Food … Read More “Personal Update #10 – November 2021 | $30,000 Stock Portfolio… Almost” »

Tag: Personal Finance

A couple of months ago, I received a notice from my local water provider. The notice was identified as an “Important Responsibility Message” with a requested response in 30 days. Then a month or so ago, I received a second notice and then just recently a third notice came that pushed the same information. The … Read More “Do You Need Water Service Line Coverage?” »

We’ve been reading about it in the news for months, people are quitting their jobs by the thousands. In August, more than 4.5 million people quit their jobs in the United States. Then you factor in the other 11.5 million people who quit earlier this year and the numbers are staggering. Anthony Klotz phrased it … Read More “The Great Resignation – Should You Quit Your Job?” »

The rule of 72 is a simple way to figure out how long it will take an amount of money to double. All you need to do is divide 72 by the annual interest rate. This will give you a relatively close estimate to the number of years before your money is doubled. [72 … Read More “What is the Rule of 72 and How Does it Work?” »

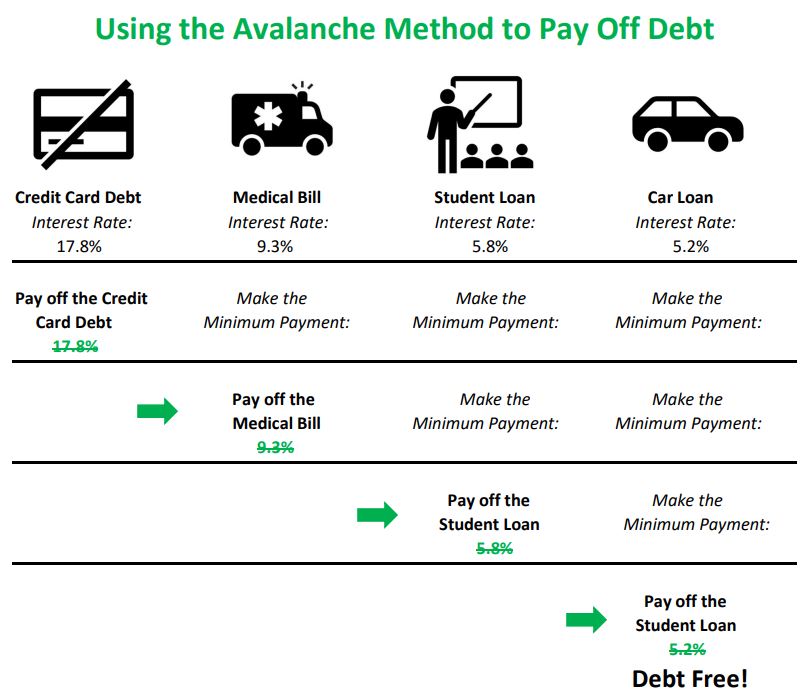

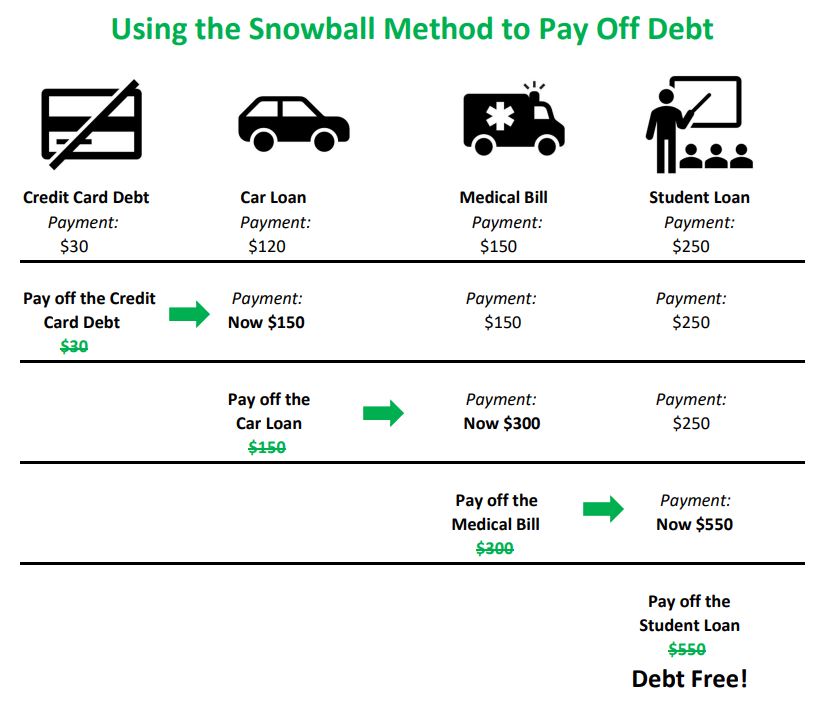

When it comes to paying off debt there are two very well-known methods, the snowball method and the avalanche method. While the Snowball method focuses on paying off the smallest loan first, the Avalanche method tackles the loan with the highest interest rate first. Both methods require you to have a clearly defined budget, a … Read More “Which Debt Repayment Method is Right for You?” »

When it comes to paying off debt there are two notable methods, the avalanche method and the snowball method. The avalanche method focuses on paying off the loan with the highest interest rate first before moving on to the next highest interest rate. Step 1: Make sure your budget is up to date. If you … Read More “How the Avalanche Method Knocks Your Debt Out Fast!” »

When it comes to paying off Debt there are two notable methods, the snowball method and the avalanche method. The Snowball method focuses on paying off the smallest loan first before moving on to the next smallest and then the next. You take the win from paying off the first loan and use that momentum … Read More “Using the Snowball Method to Tackle Debt One Snowball at a Time” »

Hey Guys! Let’s settle right in to learning about budgeting, or as l like to call it, my savings plan. First thing first, you need to remember how important it is to live within your means aka don’t spend more than you make! A common ratio passed around is 50|30|20. 50% for needs, 30% for … Read More “Learn How to Make A Budget for All Your Finances” »

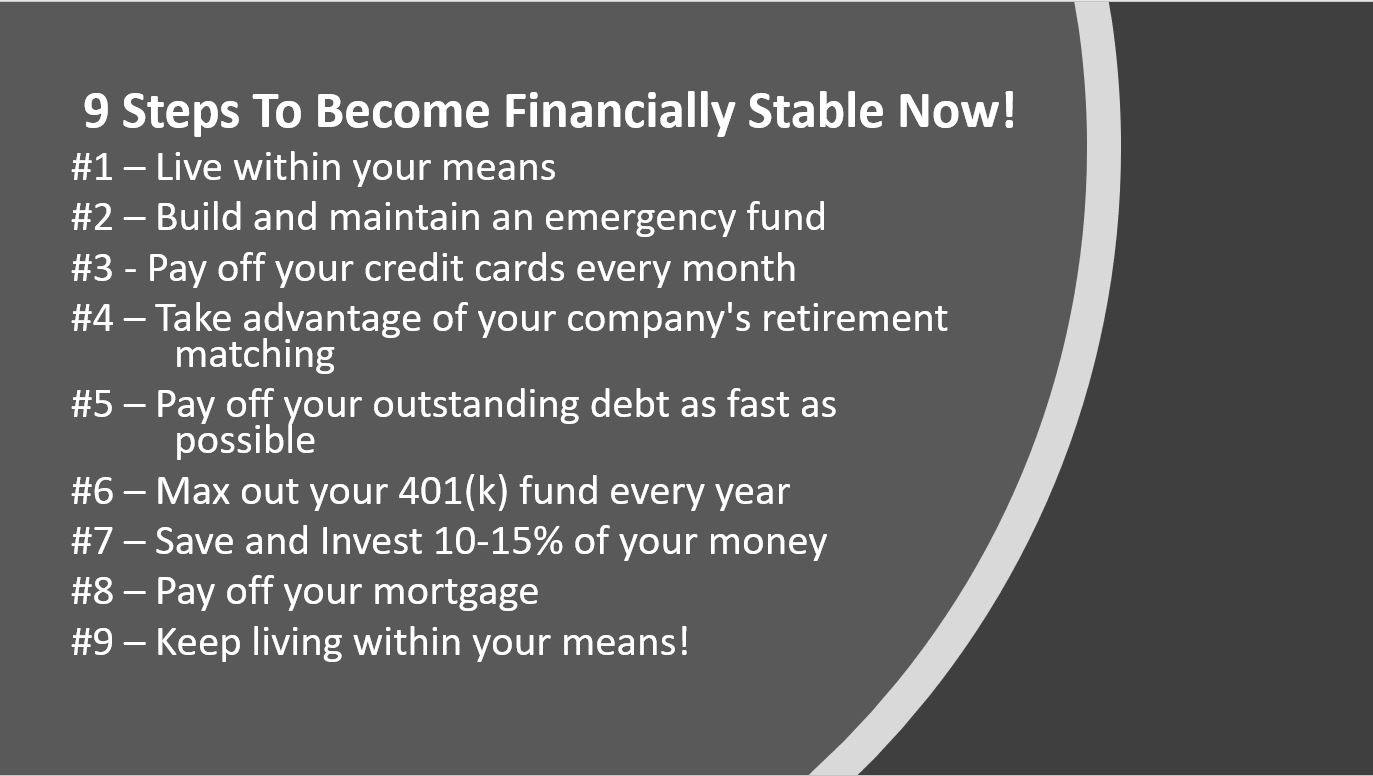

While I know we all want to be able to retire one day, that journey will be different for each of us. No one person will be at the same stage in their own process. Some might be focusing on paying off student loans while others could be focusing on saving for a down payment … Read More “9 Steps To Become Financially Stable Now!” »

We’ve talked about creating our road maps and designing goals to get us there, now let’s dig into learning about finance. Just like creating a life plan, we need a way to assess how we are doing financially. One way is to look at your net worth. What Is Net Worth? Your net worth is … Read More “Determining Your Financial Health – What Your Net Worth Means” »