Since the 1970’s, we’ve witnessed a change in how some companies manufacturing and inventory systems work. The Toyota Productions System led the charge by transitioning from a Just-In-Case inventory system to a Just-In-Time one. But what does that really mean? Just-In-Case (JIC) means enough products, parts, and inventory will be available if the supply chain … Read More “Food Storage And Its Importance With Supply Chain Shortages” »

Category: Debt

What is an emergency fund? An emergency fund is stash of cash that is readily available for unplanned expenses. It is an essential part of any financial plan and should be built up to cover three to six months of all expenses! What are emergency funds for? Emergency medical bills Home repairs and necessary appliances … Read More “Having an Emergency Fund and Why It Should Matter to You!” »

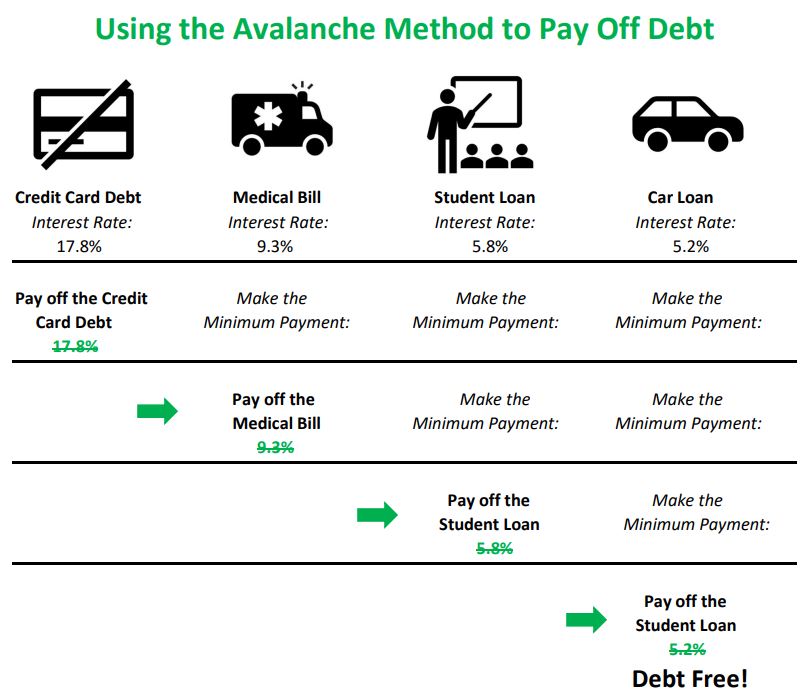

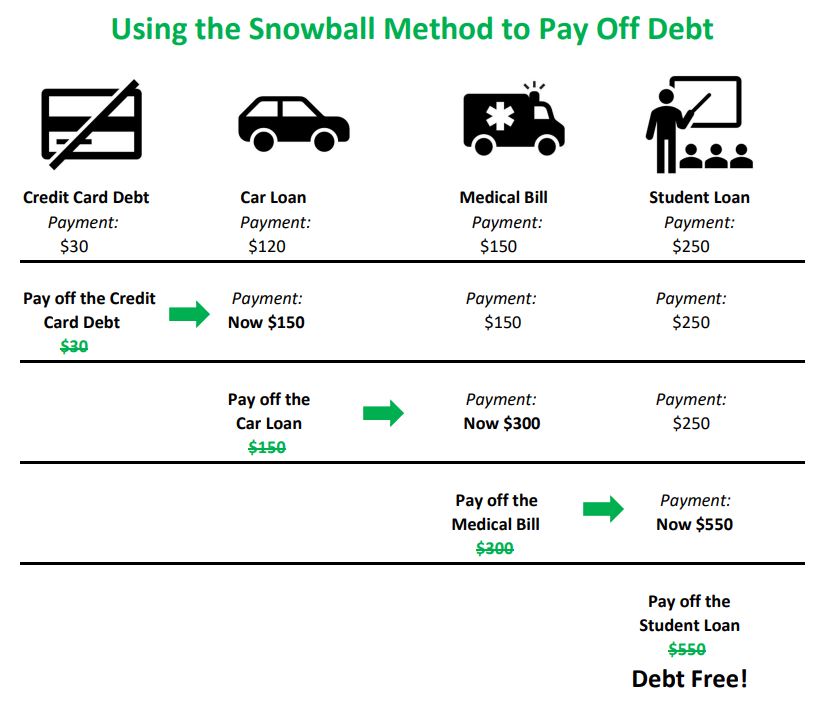

When it comes to paying off debt there are two very well-known methods, the snowball method and the avalanche method. While the Snowball method focuses on paying off the smallest loan first, the Avalanche method tackles the loan with the highest interest rate first. Both methods require you to have a clearly defined budget, a … Read More “Which Debt Repayment Method is Right for You?” »

When it comes to paying off debt there are two notable methods, the avalanche method and the snowball method. The avalanche method focuses on paying off the loan with the highest interest rate first before moving on to the next highest interest rate. Step 1: Make sure your budget is up to date. If you … Read More “How the Avalanche Method Knocks Your Debt Out Fast!” »

When it comes to paying off Debt there are two notable methods, the snowball method and the avalanche method. The Snowball method focuses on paying off the smallest loan first before moving on to the next smallest and then the next. You take the win from paying off the first loan and use that momentum … Read More “Using the Snowball Method to Tackle Debt One Snowball at a Time” »

Hey Guys! Let’s settle right in to learning about budgeting, or as l like to call it, my savings plan. First thing first, you need to remember how important it is to live within your means aka don’t spend more than you make! A common ratio passed around is 50|30|20. 50% for needs, 30% for … Read More “Learn How to Make A Budget for All Your Finances” »

In March of 2020, the Coronavirus Aid, Relief, and Economic Security Act also known as the (CARES Act) was passed dictating temporary federal student loan relief. The CARES Act initially suspended loan payments, made interest rates drop to 0% and stopped the collections on defaulted loans until September of 2020. Luckily, the loan relief was … Read More “What Does The End Of Suspended Loan Payments Mean?” »