So, you are back on job hunt or looking for your first job…. This can be stressful and frustrating! It is time to dust off your resume writing skills and get to work. Remember, it is crucial that you tailor your resume to the specific job that you are applying for! One tool that I … Read More “Building A Resume That Gets You The Job You Want!” »

Category: Blog

Today I want to focus on the current job outlook in the United States. Basically, estimations on what jobs are expected to see the highest increase in new openings and overall growth. I figured we would start out on the high note! These are currently the Highest Paying Jobs in the United States. Occupation Median … Read More “The Current Job Outlook in The United States” »

The rule of 72 is a simple way to figure out how long it will take an amount of money to double. All you need to do is divide 72 by the annual interest rate. This will give you a relatively close estimate to the number of years before your money is doubled. [72 … Read More “What is the Rule of 72 and How Does it Work?” »

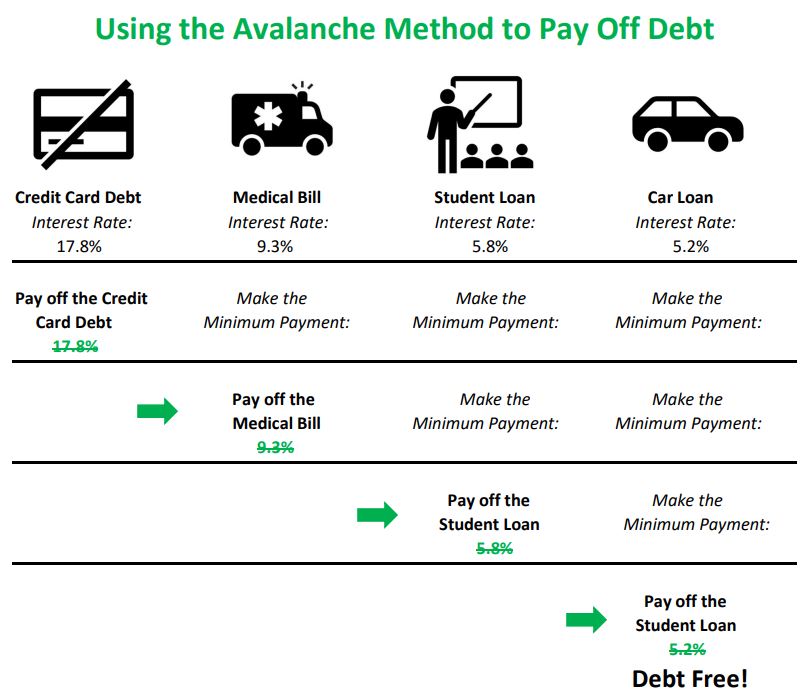

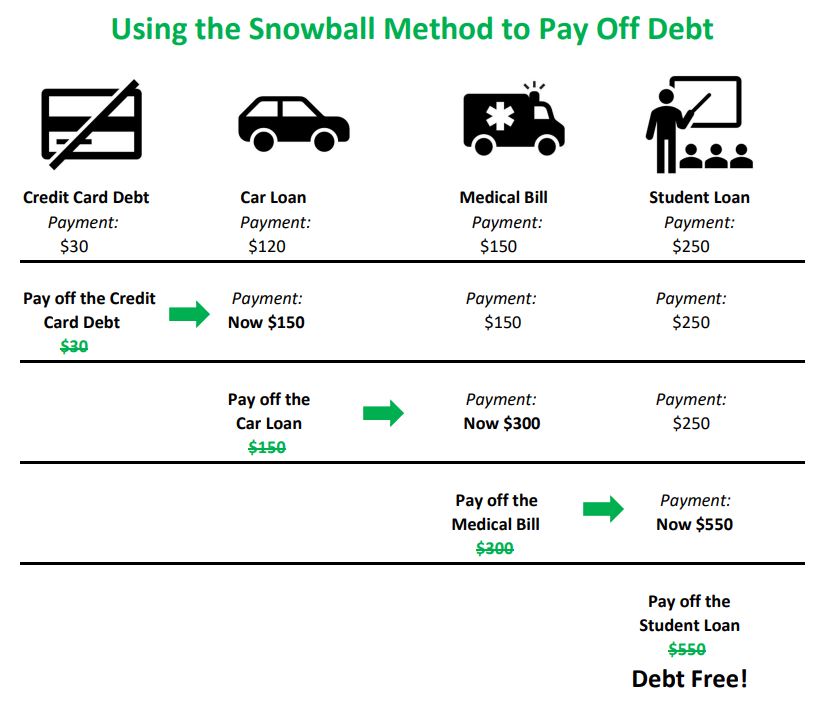

When it comes to paying off debt there are two very well-known methods, the snowball method and the avalanche method. While the Snowball method focuses on paying off the smallest loan first, the Avalanche method tackles the loan with the highest interest rate first. Both methods require you to have a clearly defined budget, a … Read More “Which Debt Repayment Method is Right for You?” »

When it comes to paying off debt there are two notable methods, the avalanche method and the snowball method. The avalanche method focuses on paying off the loan with the highest interest rate first before moving on to the next highest interest rate. Step 1: Make sure your budget is up to date. If you … Read More “How the Avalanche Method Knocks Your Debt Out Fast!” »

When it comes to paying off Debt there are two notable methods, the snowball method and the avalanche method. The Snowball method focuses on paying off the smallest loan first before moving on to the next smallest and then the next. You take the win from paying off the first loan and use that momentum … Read More “Using the Snowball Method to Tackle Debt One Snowball at a Time” »

Hey Guys! Let’s settle right in to learning about budgeting, or as l like to call it, my savings plan. First thing first, you need to remember how important it is to live within your means aka don’t spend more than you make! A common ratio passed around is 50|30|20. 50% for needs, 30% for … Read More “Learn How to Make A Budget for All Your Finances” »

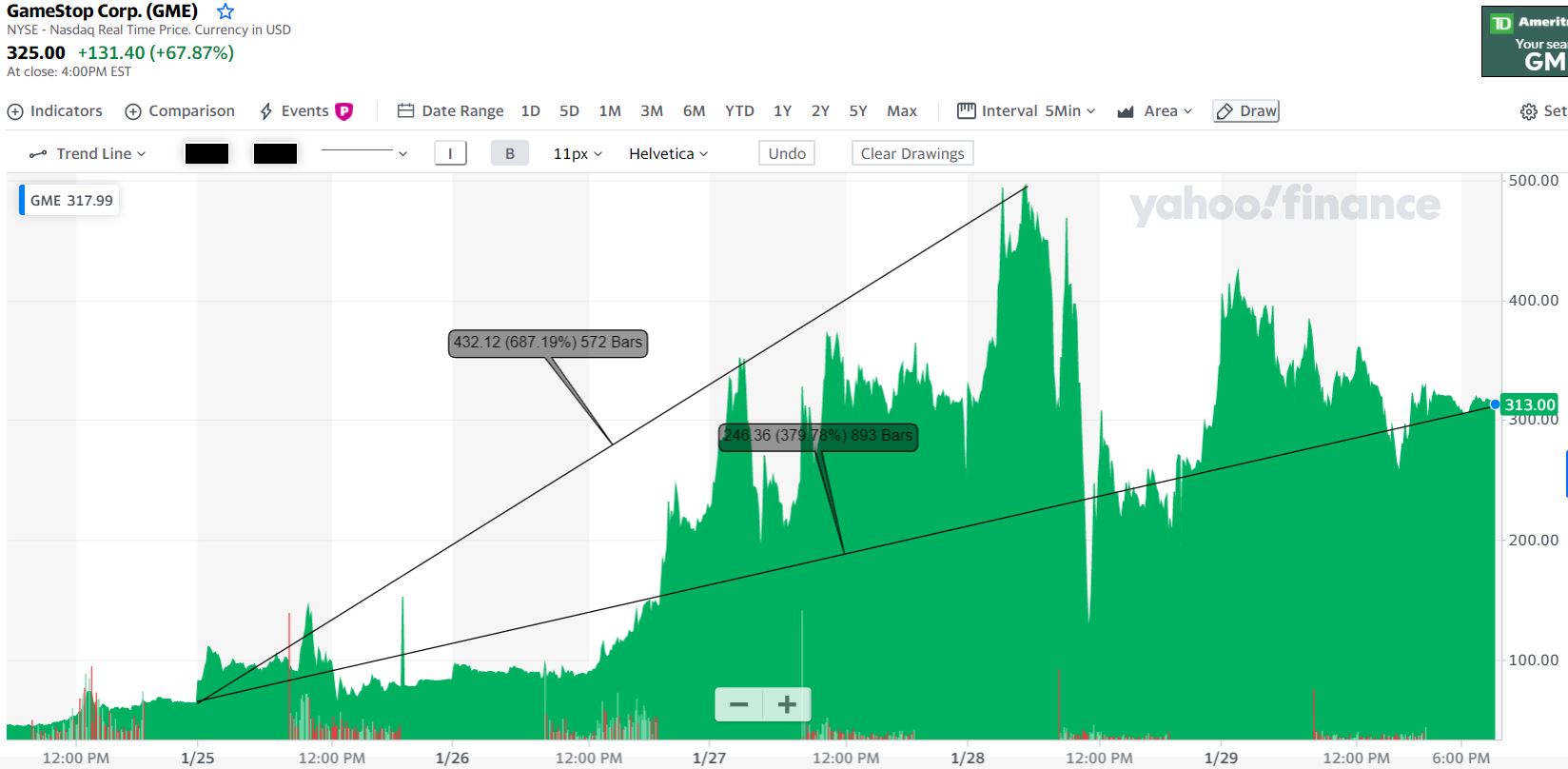

What is going on with the stock market? Well, to keep is simple, a Reddit group started a buying trend of the GameStop stock, GME, after it was identified that there were millions of shares being shorted by large hedge funds. This created a short squeeze between the Reddit group holding the shares of stock, … Read More “What Does Reddit Battling Wall Street Mean for the Average Investor?” »

In March of 2020, the Coronavirus Aid, Relief, and Economic Security Act also known as the (CARES Act) was passed dictating temporary federal student loan relief. The CARES Act initially suspended loan payments, made interest rates drop to 0% and stopped the collections on defaulted loans until September of 2020. Luckily, the loan relief was … Read More “What Does The End Of Suspended Loan Payments Mean?” »

Yay, we made it out of 2020. Congratulations! Since we are now cruising into 2021, I thought it would be a good time to look back on this past year. While 2020 was hard and pushed me out of my little bubble, it led to some high points in my life. I bought my first … Read More “2020 – A Year in Review 2020 | COVID and ALL the Craziness” »