Here are 7 ways to put your stimulus check to good use! Pay Any Late Bills Stock up on Food Storage Put it towards your Emergency Fund Max out your 2020 or 2021 IRA Pay on High Interest Debt/Loans Invest it for the long haul Donate it to a charity or someone/place in need. So, … Read More “What Should You Do With Your Stimulus Check?” »

Author: Becky Holyoak

Job interviews are always nerve-wracking for me. I have sat on both sides of the table and no matter what, I will have the jitters going through the experience. It does not matter how many interviews you have aced; it is crucial to prepare and plan ahead for each one. “If you fail to plan, … Read More “How To Prepare For A Job Interview” »

Just as you customize your resume for the job posting you should also customize your cover letter. With sometimes a hundred or more people applying for one single position, take any opportunity to show your voice and what you are passionate about. But do not lay it on too thick! It is okay to be … Read More “Why A Cover Letter Is Important When Applying for A Job!” »

So, you are back on job hunt or looking for your first job…. This can be stressful and frustrating! It is time to dust off your resume writing skills and get to work. Remember, it is crucial that you tailor your resume to the specific job that you are applying for! One tool that I … Read More “Building A Resume That Gets You The Job You Want!” »

Today I want to focus on the current job outlook in the United States. Basically, estimations on what jobs are expected to see the highest increase in new openings and overall growth. I figured we would start out on the high note! These are currently the Highest Paying Jobs in the United States. Occupation Median … Read More “The Current Job Outlook in The United States” »

The rule of 72 is a simple way to figure out how long it will take an amount of money to double. All you need to do is divide 72 by the annual interest rate. This will give you a relatively close estimate to the number of years before your money is doubled. [72 … Read More “What is the Rule of 72 and How Does it Work?” »

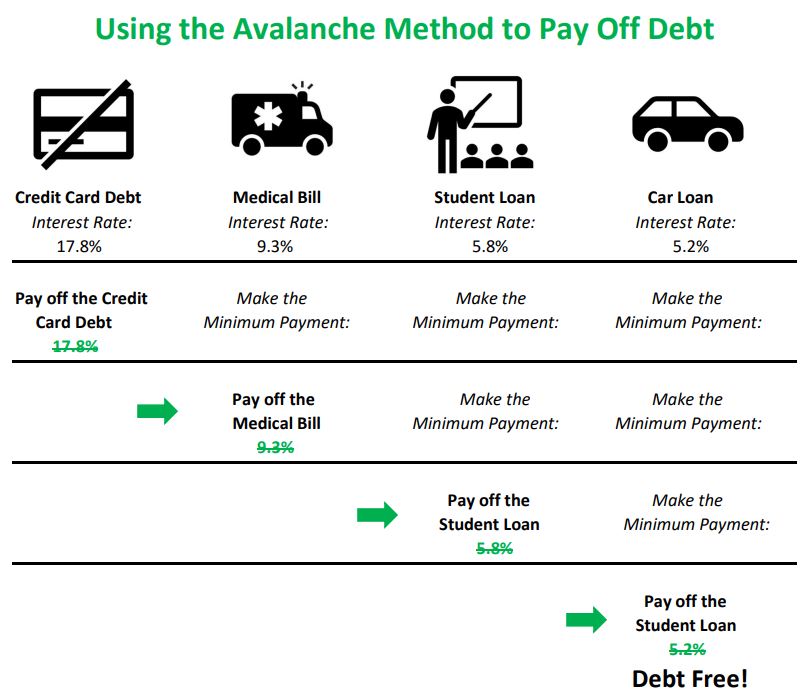

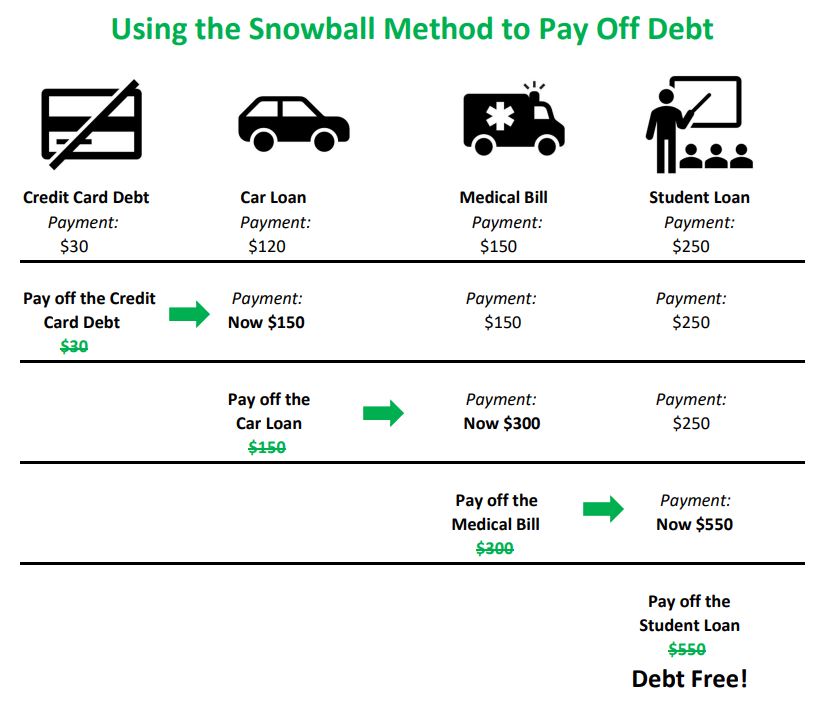

When it comes to paying off debt there are two very well-known methods, the snowball method and the avalanche method. While the Snowball method focuses on paying off the smallest loan first, the Avalanche method tackles the loan with the highest interest rate first. Both methods require you to have a clearly defined budget, a … Read More “Which Debt Repayment Method is Right for You?” »

When it comes to paying off debt there are two notable methods, the avalanche method and the snowball method. The avalanche method focuses on paying off the loan with the highest interest rate first before moving on to the next highest interest rate. Step 1: Make sure your budget is up to date. If you … Read More “How the Avalanche Method Knocks Your Debt Out Fast!” »

When it comes to paying off Debt there are two notable methods, the snowball method and the avalanche method. The Snowball method focuses on paying off the smallest loan first before moving on to the next smallest and then the next. You take the win from paying off the first loan and use that momentum … Read More “Using the Snowball Method to Tackle Debt One Snowball at a Time” »

Hey Guys! Let’s settle right in to learning about budgeting, or as l like to call it, my savings plan. First thing first, you need to remember how important it is to live within your means aka don’t spend more than you make! A common ratio passed around is 50|30|20. 50% for needs, 30% for … Read More “Learn How to Make A Budget for All Your Finances” »