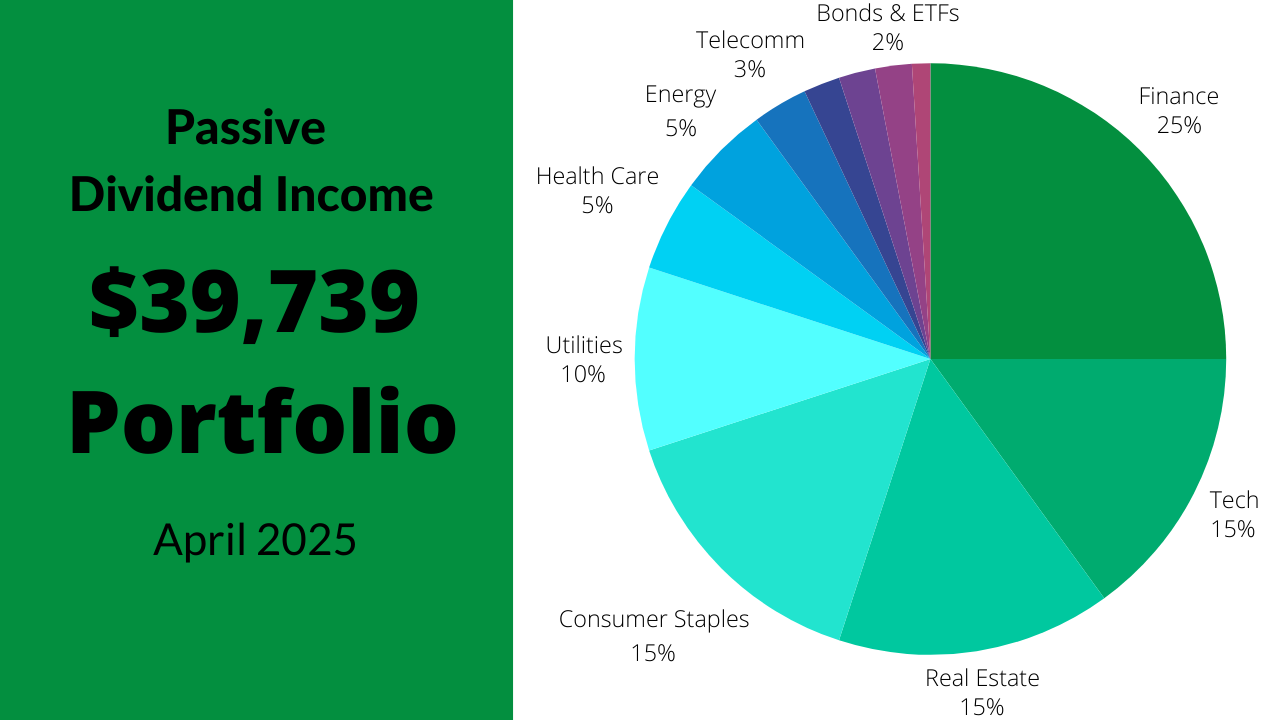

I have a self-directed brokerage account with Ally. My overall goal is for the portfolio to function as a long-term dividend growth account that generates around $2,000 per month in dividends. My diversification strategy is broken-down by these different sectors and areas – Portfolio Overview – We closed out the month of April with the … Read More “Dividend Income April 2025 – $ Stock Portfolio” »

Author: Becky Holyoak

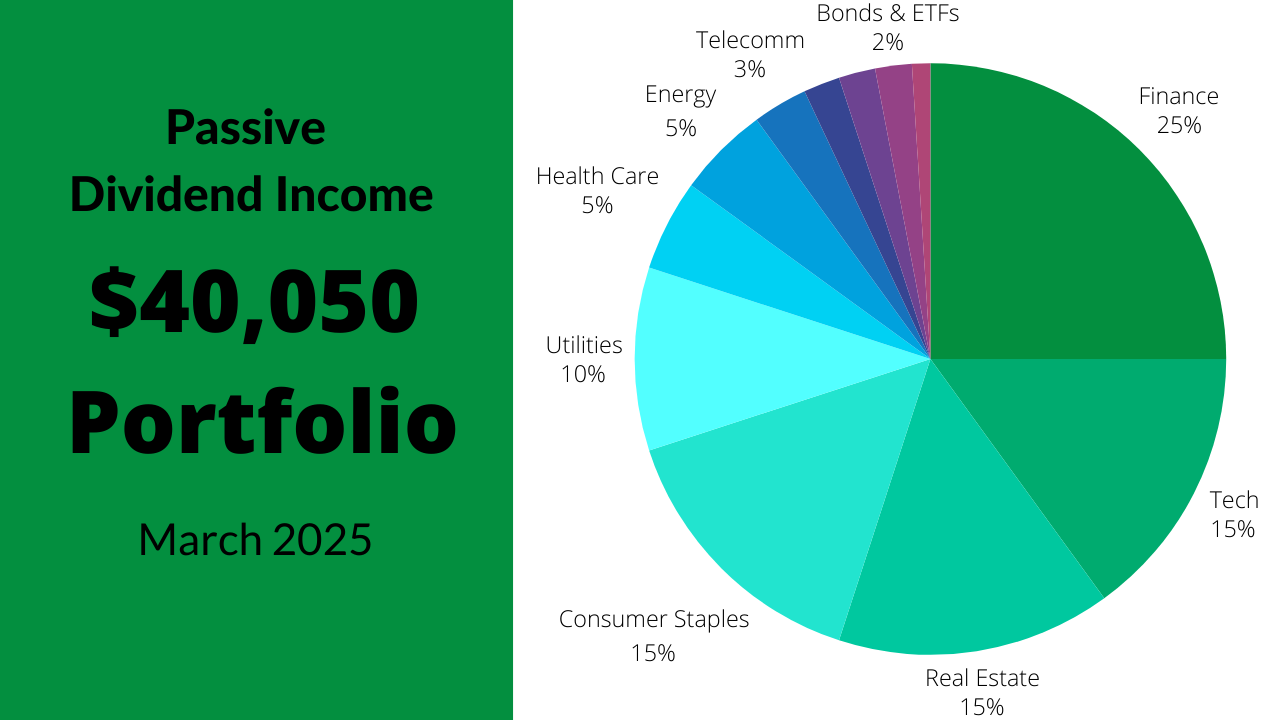

I have a self-directed brokerage account with Ally. My overall goal is for the portfolio to function as a long-term dividend growth account that generates around $2,000 per month in dividends. My diversification strategy is broken-down by these different sectors and areas – Portfolio Overview – We closed out the month of March with the … Read More “Dividend Income March 2025 – $40,050 Stock Portfolio” »

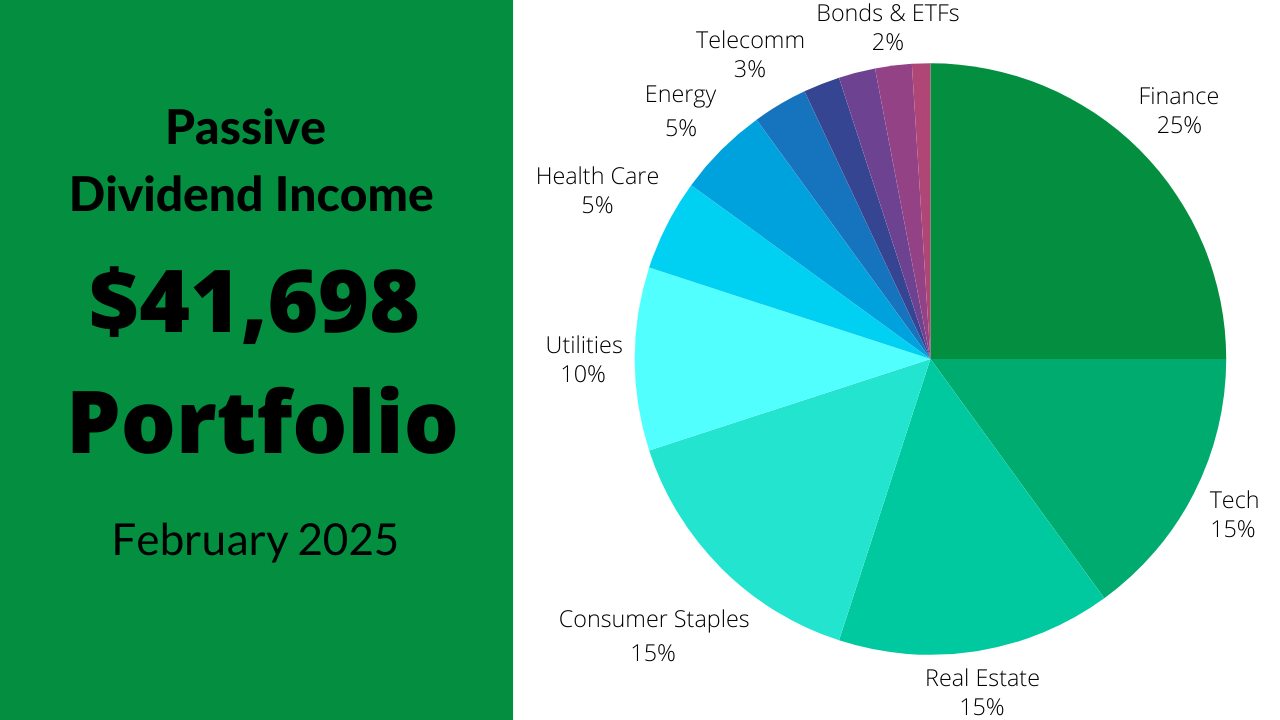

I have a self-directed brokerage account with Ally. My overall goal is for the portfolio to function as a long-term dividend growth account that generates around $2,000 per month in dividends. My diversification strategy is broken-down by these different sectors and areas – Portfolio Overview – We closed out the month of February with the … Read More “Dividend Income February 2025 – $41,698 Stock Portfolio” »

We all know that money is tight for everyone! If you are like me and countless others, you want to earn a little extra money this year. Between inflation and the rising cost of food our budgets are tighter than ever! That is where this breakdown comes in… I want to share all the different … Read More “Breaking Down All Of My Side Hustle Income – 2024” »

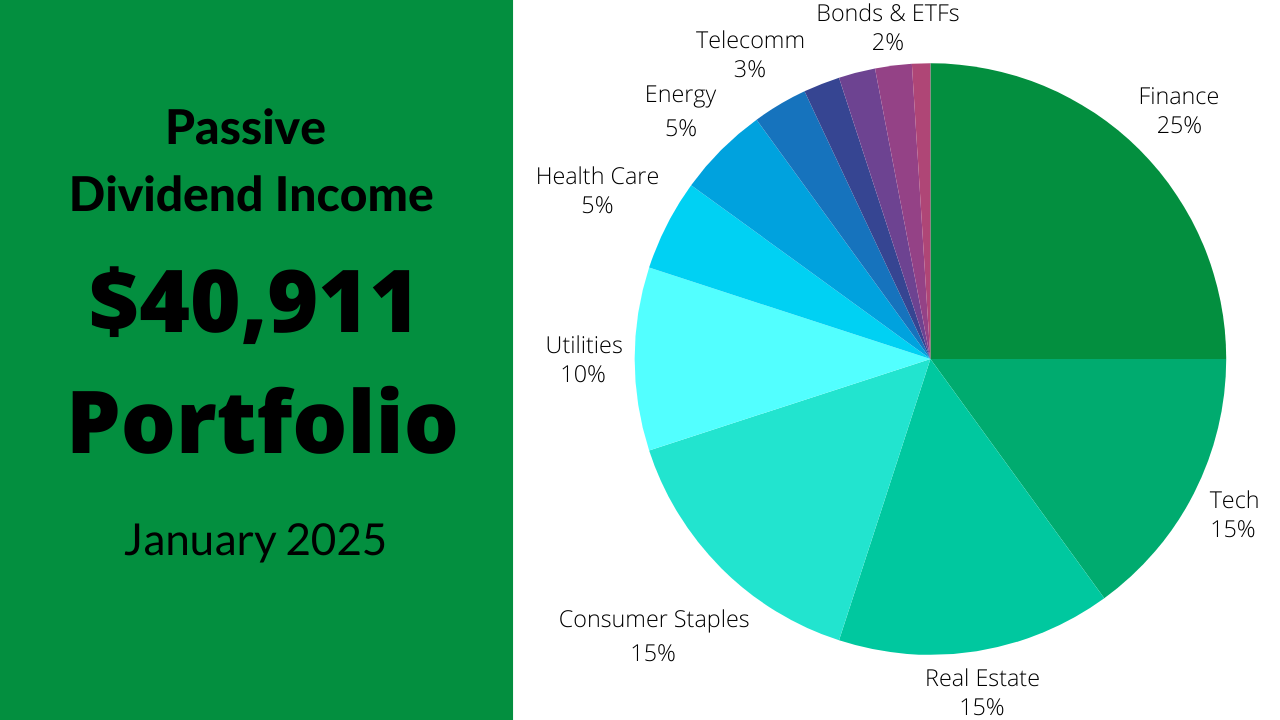

I have a self-directed brokerage account with Ally. My overall goal is for the portfolio to function as a long-term dividend growth account that generates around $2,000 per month in dividends. My diversification strategy is broken-down by these different sectors and areas – Portfolio Overview – We closed out the month of January with the … Read More “Dividend Income January 2025 – $40,911 Stock Portfolio” »

I want to share my experience from the first 30 days of hosting through Airbnb and Furnished Finder. Feel free to jump down to a different section: Last fall, I moved in with my fiancé and together we spent way too much time renovating my old house to get it up and running as a … Read More “A Look At My First Month Hosting Through Airbnb” »

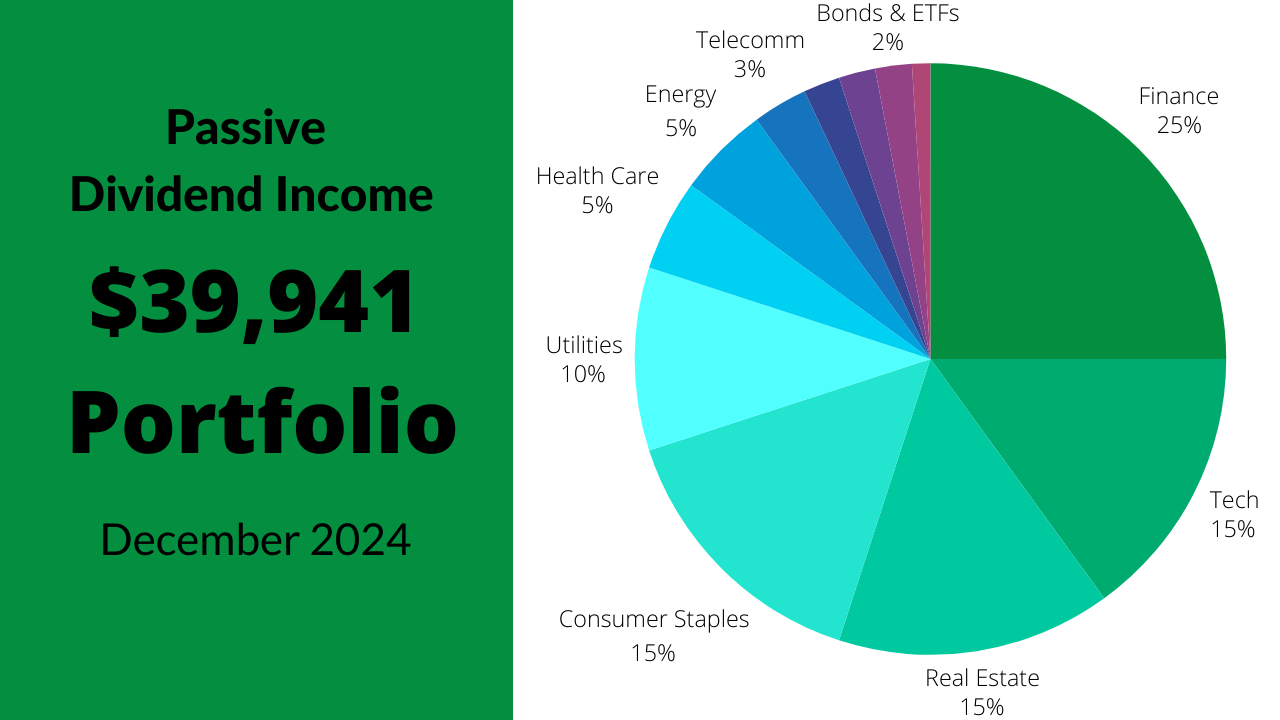

I have a self-directed brokerage account with Ally. My overall goal is for my portfolio to function as a long-term dividend growth account that generates around $2,000 per month in dividends. My Stock Portfolio Diversification Strategy My diversification strategy is broken-down by these different sectors and areas – My excel sheet updates the percentages so I can easily see … Read More “Breaking Down My $39,941 Stock Portfolio – December 2024” »

I have a self-directed brokerage account with Ally. My overall goal is for the portfolio to function as a long-term dividend growth account that generates around $2,000 per month in dividends. My diversification strategy is broken-down by these different sectors and areas – Portfolio Overview – We closed out the month of September with the … Read More “Dividend Income December 2024 – $39,941 Stock Portfolio” »

When looking at renting out my old house, the question raised is how to go about doing so. The biggest question was what would work best for me right now. Since I moved in with my girlfriend, now fiancée, I didn’t need to take the majority of my furniture with me. So, the house was … Read More “Short-Term vs Long-Term Rental – How I Made My Decision” »

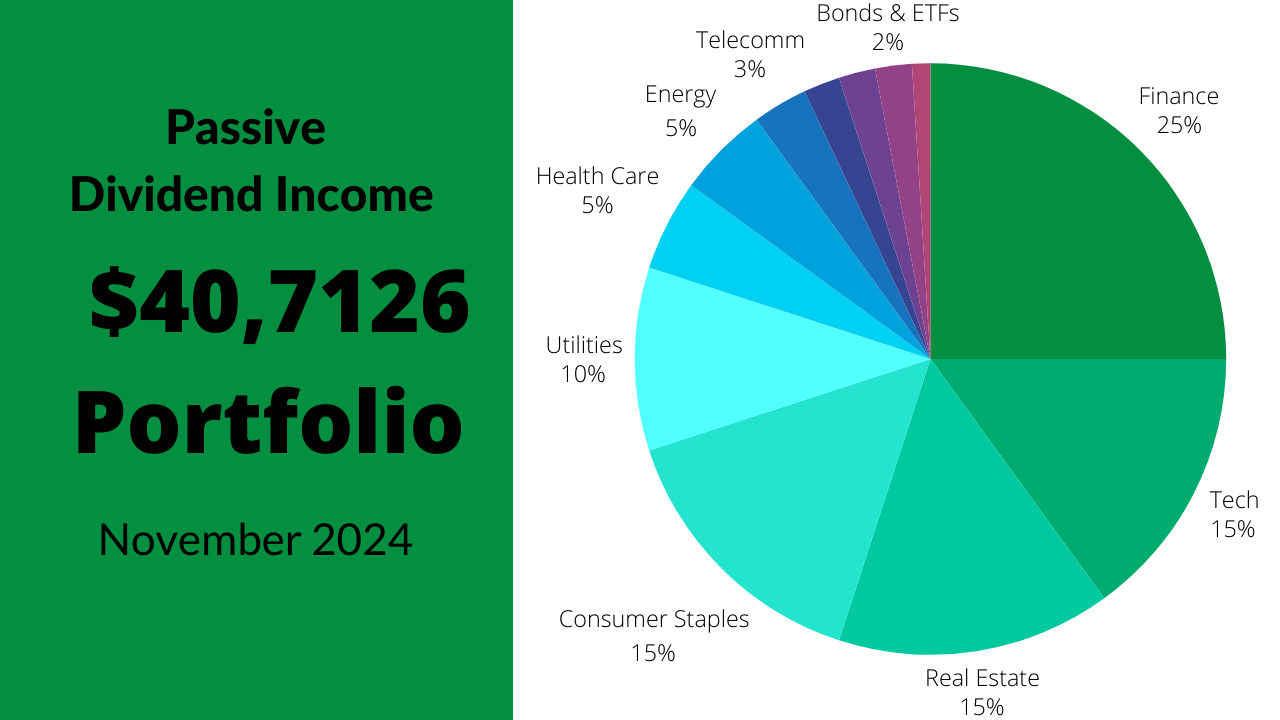

I have a self-directed brokerage account with Ally. My overall goal is for the portfolio to function as a long-term dividend growth account that generates around $2,000 per month in dividends. My diversification strategy is broken-down by these different sectors and areas – Portfolio Overview – We closed out the month of November with the … Read More “Dividend Income November 2024 – $40,712 Stock Portfolio” »