What is going on with the stock market? Well, to keep is simple, a Reddit group started a buying trend of the GameStop stock, GME, after it was identified that there were millions of shares being shorted by large hedge funds. This created a short squeeze between the Reddit group holding the shares of stock, and the large hedge funds that need to buy. Thus, creating an incredibly volatile market while this standoff plays out.

What is a Short Position? (It’s complicated….)

A short occurs when you borrow a share of stock from one person, then sell that share of stock (which is temporarily yours and you must buy it back in order to return it) to someone else. The idea is that you think the price of the stock will go down ↓, then you will buy that share of stock back at a price that is below what you originally borrowed the share at. Meaning you will make a profit because the stock price fell.

Why Does it Matter?

When you buy a stock and the prices falls, the most money you can lose is the initial amount invested. But when you short a stock, there is no limit to how high the price can increase. The price can go up hundreds of dollars. And because you must buy back the share, because you only temporarily own it, you can lose hundreds of dollars more than the initial amount invested.

What Makes This Situation Unique?

The big hedge funds on Wallstreet were almost positive that GameStop’s stock price was overvalued and would decrease so they shorted it like crazy. But that view was not the same for everyone. Michael Burry (who is a key player who “The Big Short” movie is about) made it known that he owns shares in GameStop. Other everyday “retail” investors started buying shares thinking some positive changes were coming. Especially once Ryan Cohen (the co-founder of Chewy) joined the board of GameStop after making a large investment into its stocks, in the fall of 2020.

The Reddit Group “WallStreetBets” identified the opportunity to make a profit off the large hedge fund’s vulnerability. More than 100% of the available shares in the market had been shorted, (still sitting around 120% currently shorted). That meant that more people had to buy back shares than there were shares available. The group started encouraging people to buy GameStop stock, leading to a short squeeze. (Where more people trying to buy back their short positions, in order to return them, than there are stocks available to buy. Leaving the power to set the selling price in the hands of those selling.)

For example, think of the toilet paper rush of 2020. The demand for rolls of toilet paper skyrocketed basically overnight. There was not enough toilet paper for everyone to get all that they wanted. Some people had bought more than they needed and started selling toilet paper online for double or triple the value. They knew the supply was limited and the demand was high because people needed toilet paper. That is what WallStreetBets is doing to big Wall Street and the hedge funds. They have what the hedge funds need, shares of stock, and are planning to sell them at a much higher price because the hedge funds must return the shares of stock that they already owe.

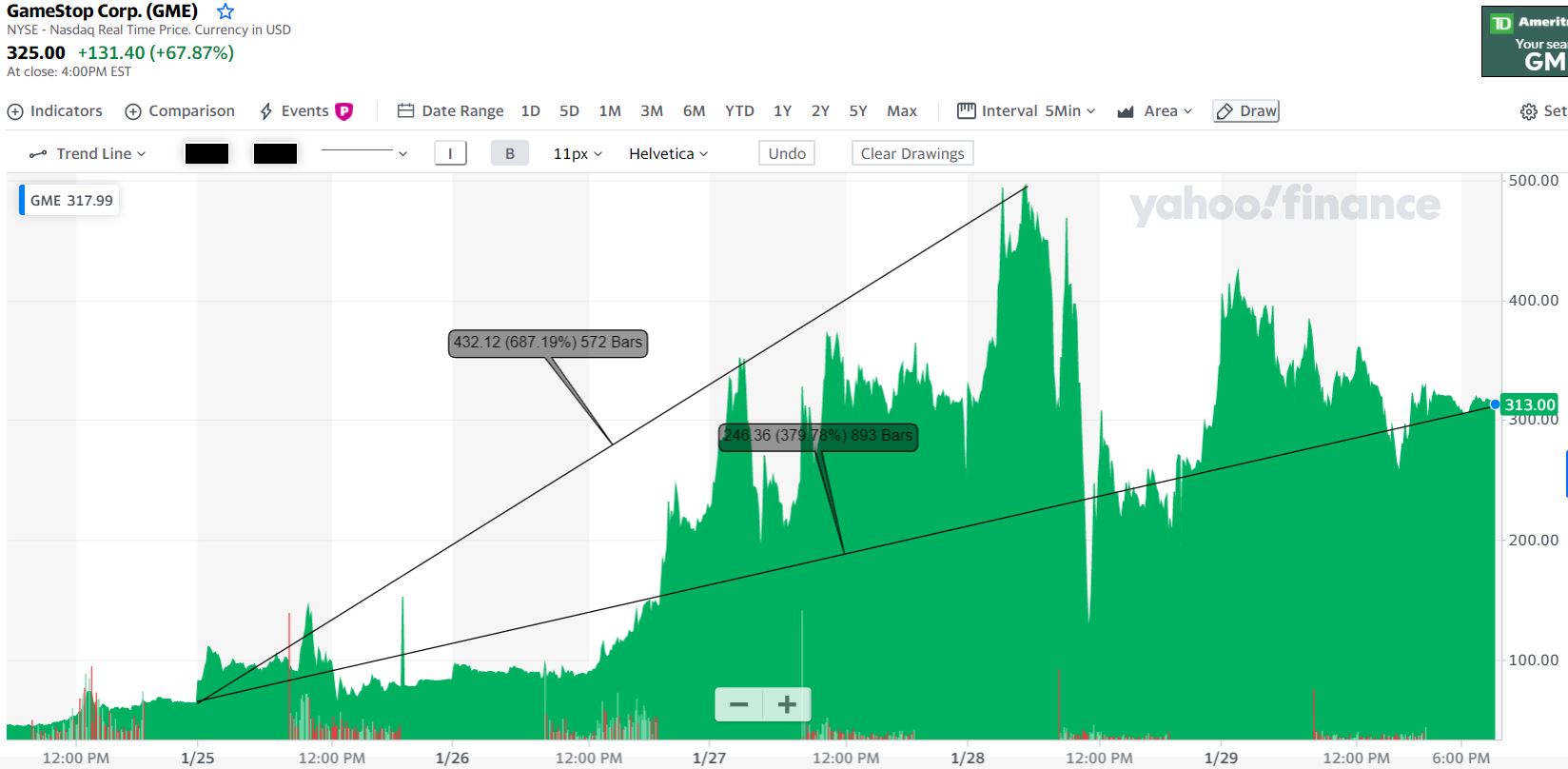

Social media has had a large impact on this situation, sending it viral. With the Reddit group encouraging everyday investors to buy GameStop shares and influencers tweeting and sharing the message, the stock price and been all over the board this past week. The highest price was $468 on Jan 28th, which was closely followed by the low price of $162 within less than 3 hours!

This has had a huge impact on the price of GameStop. At the beginning of this week GameStop stock was valued at $64 a share. By the end of trading yesterday, the price was $325 a share. The short squeeze didn’t stop with GameStop, it then moved on to AMC Theatres, Blackberry, and other volatile stocks. The hedge funds and large investors have felt the losses of more than $70 billion already.

To top it all off, certain trading apps commonly used by everyday “retail” investors are being called into question for potentaially limiting the trading of these stocks. Even class-action lawsuts have been filed against because customers were not able to trade GameStop or other volitile stocks. Kinda of similar to what happened with the toilet paper rush, the supply went down and the demand went sky high so big businesses started limiting the amount of toilet paper you could buy at one time. When it happened some people were mad because they did have enough and others were happy because they knew it would stop people abusing the sitaiton for their own profit.

The difference with this short squeeze is that those who need the toilet paper are the wealthy people who repeatedly have gotten handouts when the stock market tanked. And the everyday people took the loses out of their own retirement and investment accounts leaving some with nothing. Today that role is semi reversed. The everyday retail traders hold the supply and the big, wealthy hedge funds need that toilet paper. They might be able to hold out for a few days before they start paying more than the toilet paper is worth, but eventually the price of toilet paper will fall back to the normal parameters.

That is why this situation is so risky for both sides. If you buy stock for $400 more than it is really worth and you can’t sell it before the market evens out, you could loose $400 dollars. No one really knows exactly how this is going to play out or how long it will go on. If you try and jump on the bandwagon, you could end up losing a lot of money. GameStop and the other stocks being targeted are not following the traditional market rules. How this plays out is all up in the air!

As a formal disclosure, I am not a financial advisor. I am not giving you the advice to buy or sell or watch the stocks go up and down. I am giving you the resources to learn and conduct your own research about what is going on with the market today.

Resources:

https://apnews.com/article/gamestop-stock-surge-explained-fb377363d1b04809706619a6bcc9e549

https://www.vox.com/the-goods/22249458/gamestop-stock-wallstreetbets-reddit-citron/

© EuduringFinances, 2021. All Rights Reserved.

Related Posts –

One thought on “What Does Reddit Battling Wall Street Mean for the Average Investor?”

Comments are closed.